TL;DR

- Median age to hit $1M+: 39 years old

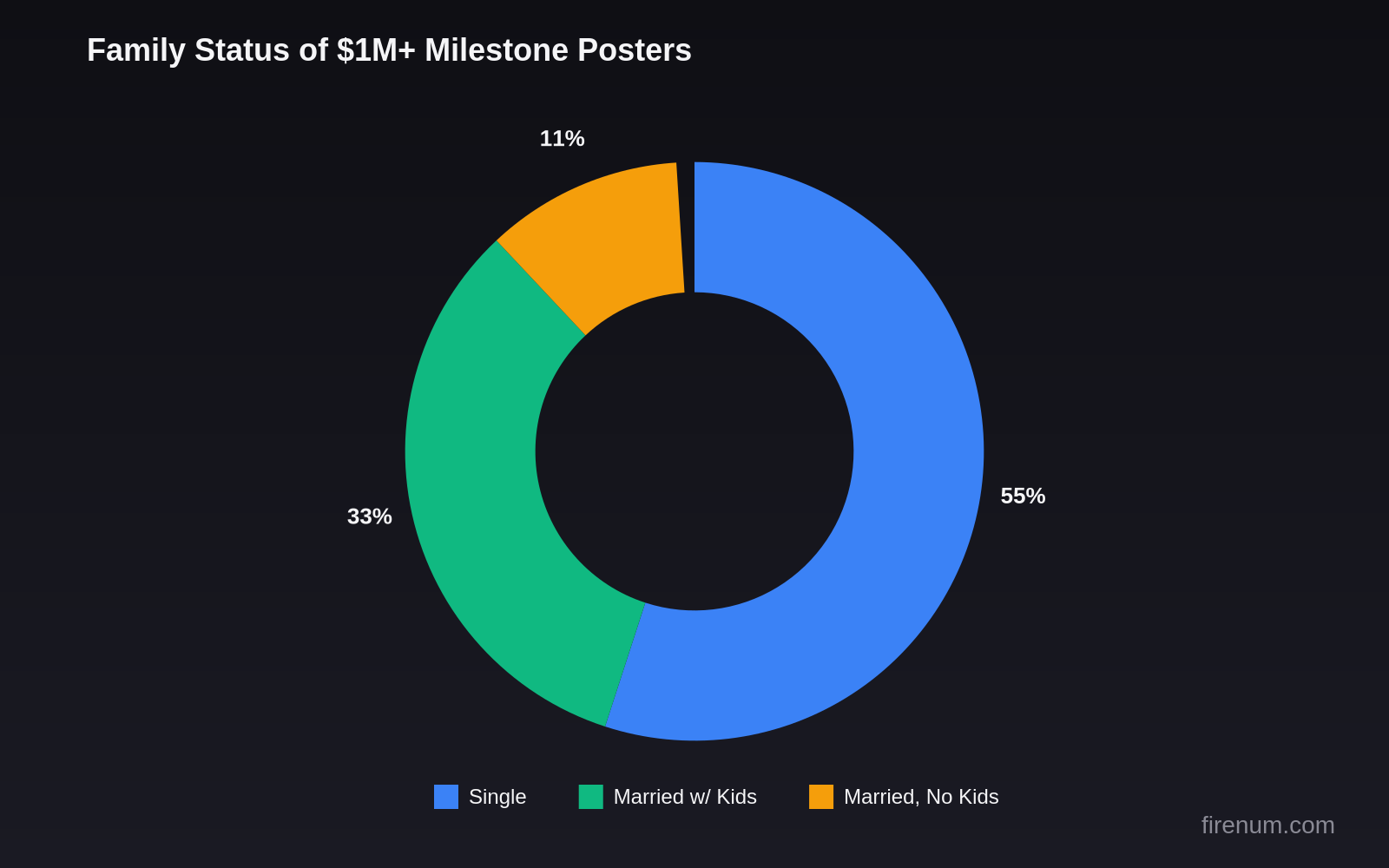

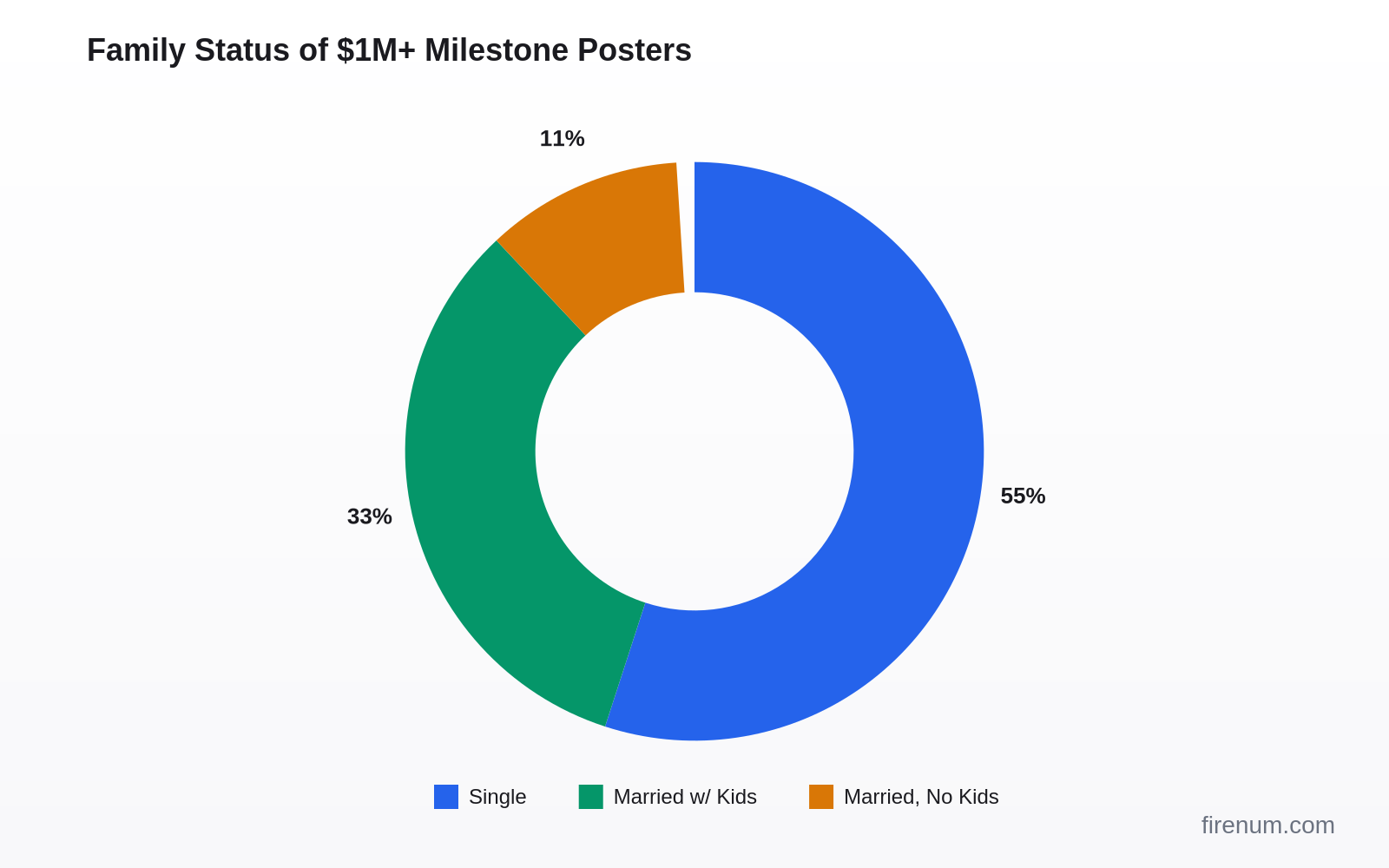

- 55% are single — dual income not required

- 20% never earned over $100k — high income helps but isn't mandatory

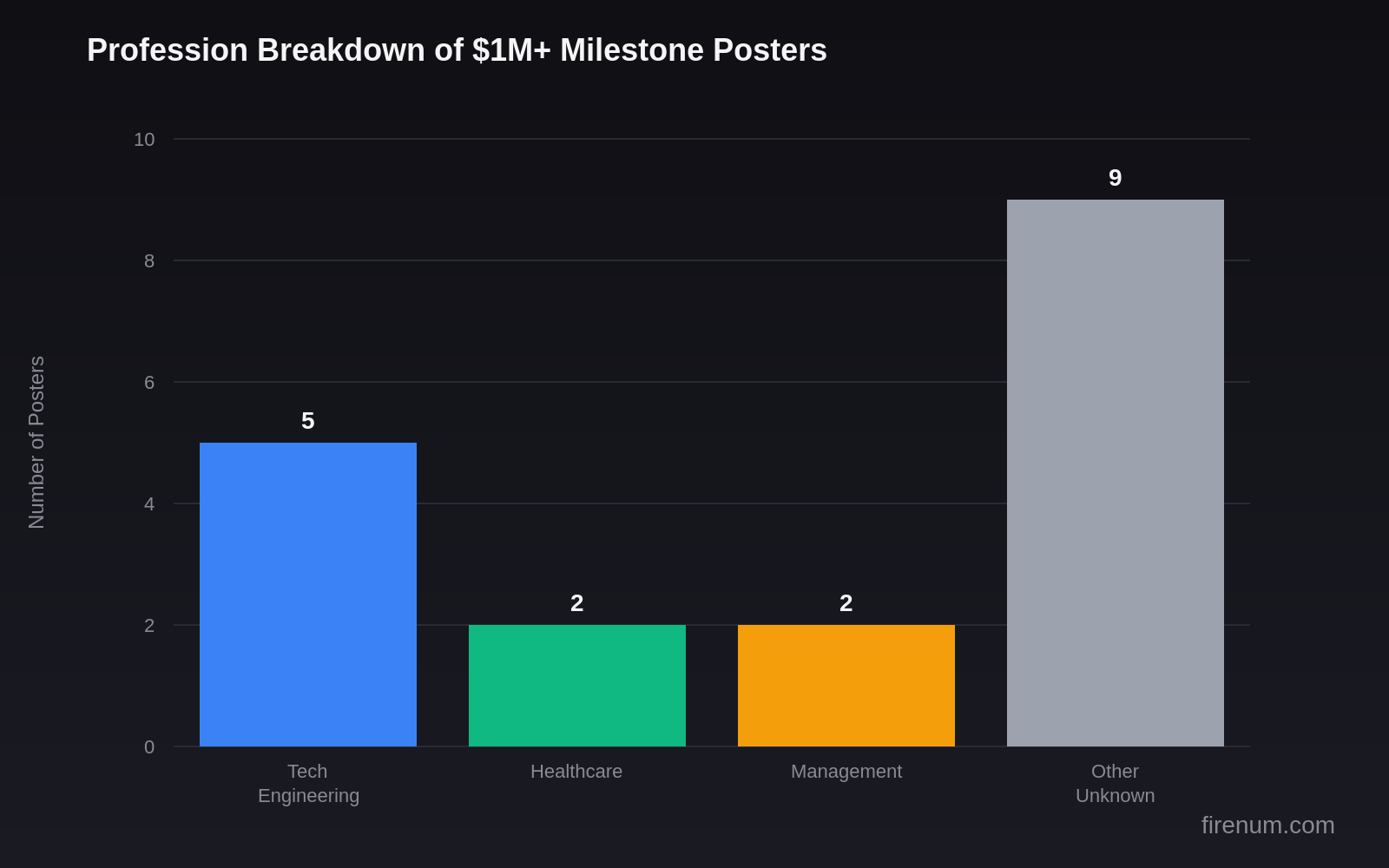

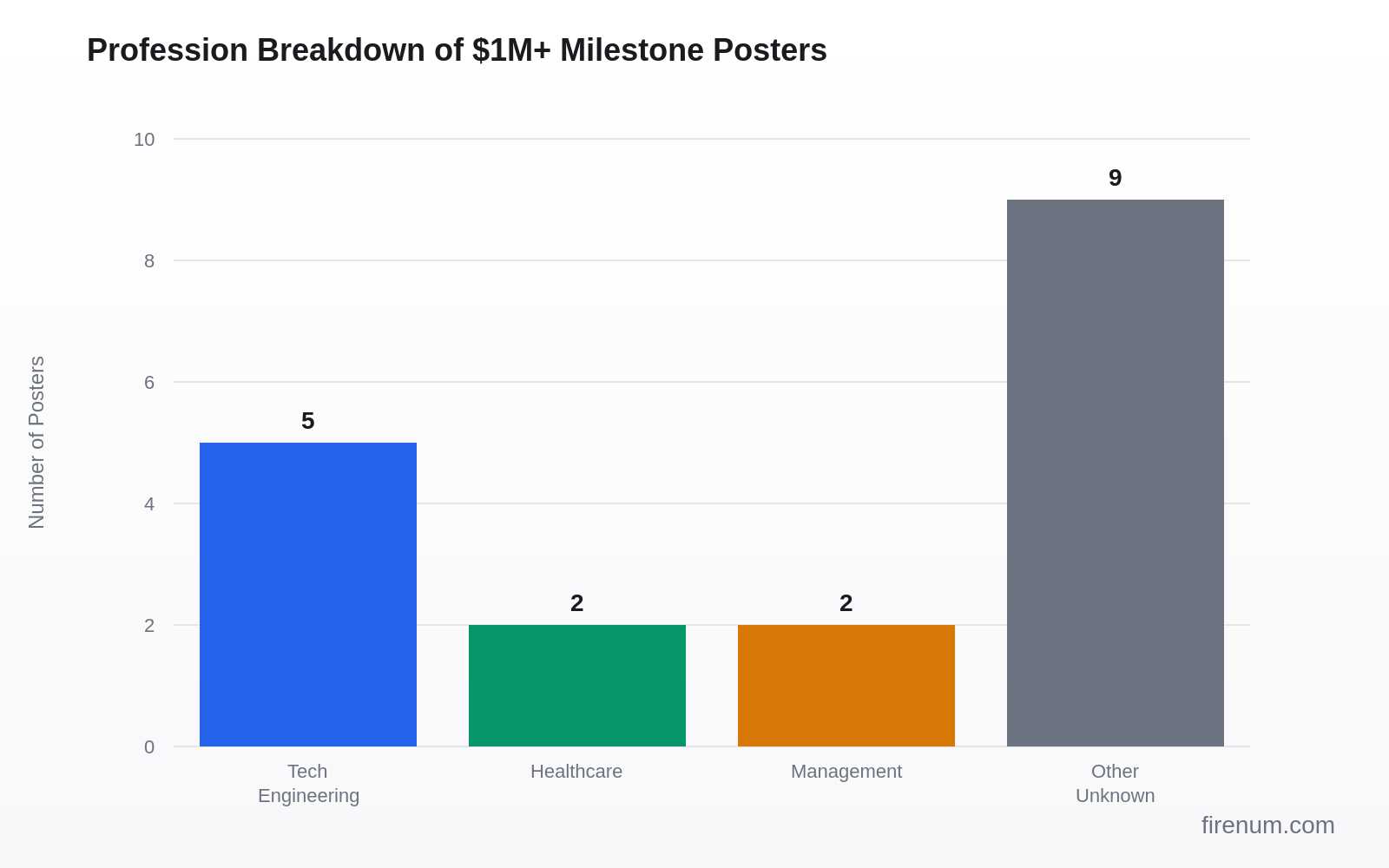

- Top profession: Tech (28%), but healthcare, management, and other fields well-represented

What We Did

We analyzed milestone posts from r/Fire over the past 6-12 months. We extracted age, net worth, income, family status, and profession from posts where users shared their FIRE milestones. After removing duplicates and posts without extractable data, we had 18 unique individuals who hit $1M+ net worth milestones.

This isn't a scientific study. It's a snapshot of who's actually hitting FIRE milestones and posting about it on Reddit. The biases are real (self-selection, Reddit demographics, US-centric), but the data is still revealing.

Key Findings

Median Age at $1M+: 39

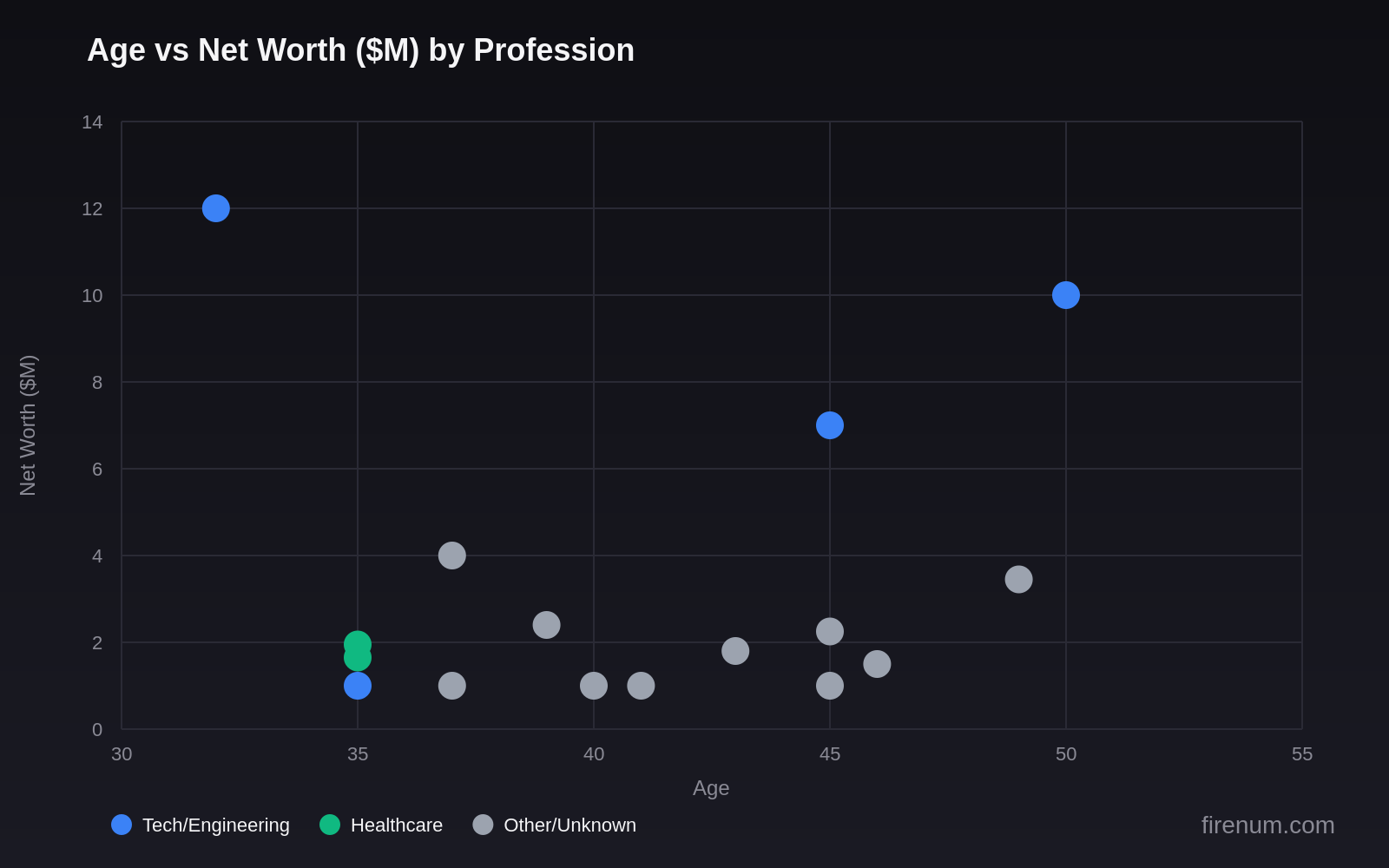

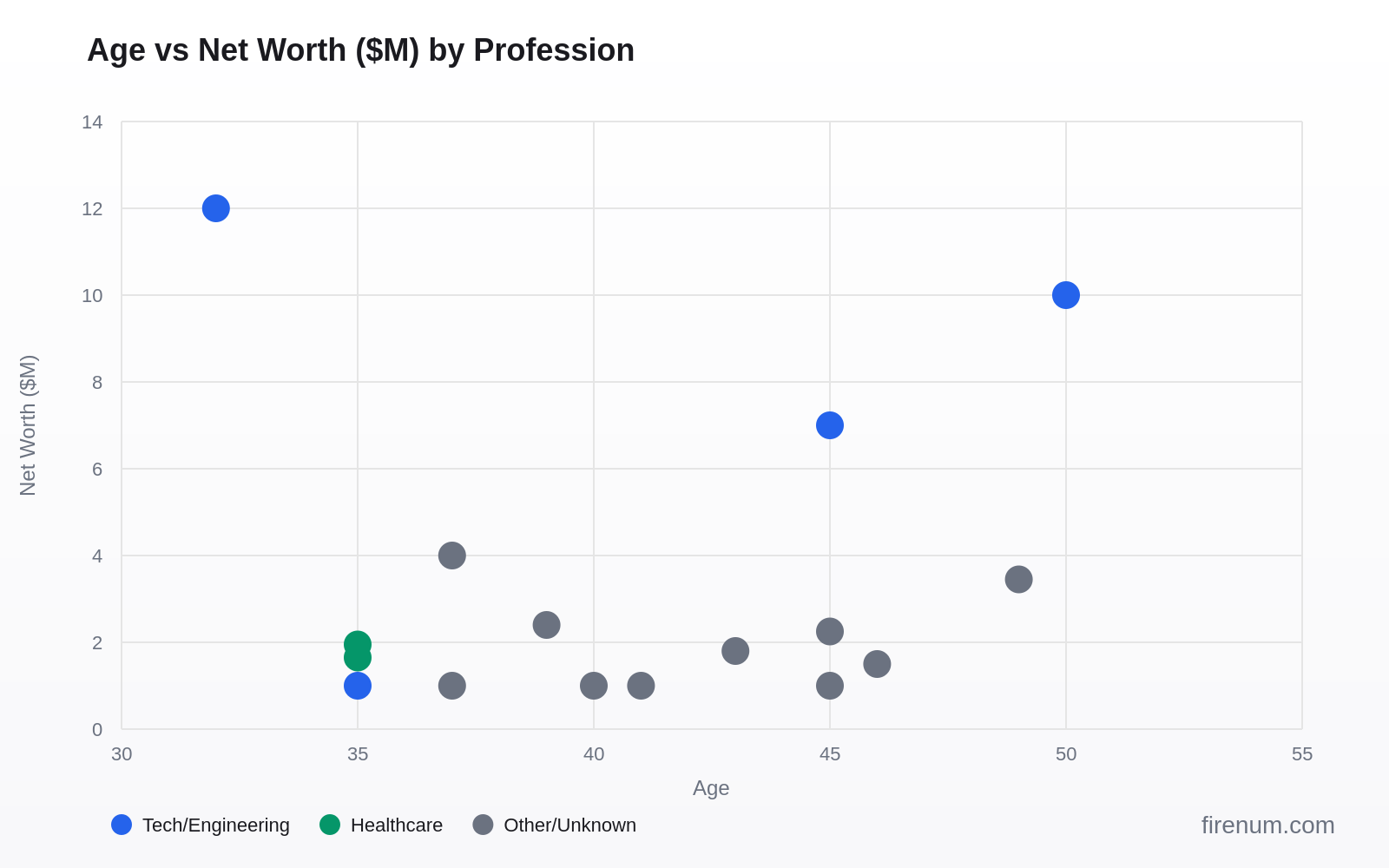

The ages of $1M+ milestone posters ranged from 32 to 50, with a heavy cluster in the mid-30s. The median age was 39 years old.

This is younger than most people expect. The "boring middle" of FIRE — those years of steady accumulation — often ends earlier than you think.

You Don't Need a Huge Salary

Of the 10 milestone posters who disclosed their income, 2 (20%) hit $1M+ while never earning over $100k.

The most striking example:

"I've never made more than $80k, which is below average income in my NorCal city. Reaching $1M in my IRA accounts was the final silly goalpost I set for myself." — 39yo with $2.4M net worth

Another poster hit $1M at age 40 while earning $73k — the same job for 15 years. High income accelerates FIRE, but it's not the only path.

More Than Half Are Single

Of the $1M+ milestone posters with disclosed family status:

- 55% are single

- 33% are married with kids

- 11% are married without kids

The "you need dual income" assumption doesn't hold up. Many FIRE achievers do it solo. Meanwhile, couples with multiple kids are also hitting milestones — proving that family doesn't disqualify you either.

"We didn't have tech salaries or come from wealthy families, and we had four kids to raise." — 46F who FIRE'd at 45 with $1.5M

Tech Dominates at the Top, But Not the Middle

Tech and engineering make up about 28% of milestone posters — and they dominate the highest net worth brackets ($5M+). But the $1-2M range is more diverse:

- Healthcare workers: A nurse hit $1.65M at 35

- Project managers: Multiple $1M milestones

- Insurance management + hardware store worker: Couple FIRE'd with $1.5M

- Teacher's spouse: Dual income $1M at 37

You don't need to be a software engineer to hit $1M. You need time, consistency, and a reasonable savings rate.

Quotable Stats

| Stat | Value |

|---|---|

| Median age at $1M+ | 39 |

| % single among $1M+ posters | 55% |

| % who never earned over $100k | 20% |

| Most common profession | Tech/Engineering (28%) |

| Age range | 32 - 50 |

| Net worth range | $1M - $12M |

Stories That Stand Out

The Low-Income Millionaire: 39yo in NorCal who never earned over $80k, now has $2.4M. Key factors: started investing at 22, lived with roommates for a decade, gamer with cheap hobbies, aggressive index fund investing.

The Family of Six: 46F and husband (insurance management + hardware store) FIRE'd with $1.5M after a 13-year journey. Four kids. No tech salaries. Key: dramatic housing downsize (2,500 sqft to 1,000 sqft), cash cars, 50% savings rate.

The Accidental Retiree: Got fired after AI meeting notes captured his comments about his boss. Already had enough saved. Now doing "chiller, easier" work.

The Founding Engineer: 32yo from a lower middle class family in India, founding engineer at a startup that went to Nasdaq. $12M after the stock "blew up." Sent $550k to his sister immediately.

Methodology

We searched r/Fire for posts from the past 6-12 months using these terms:

- Milestone flair

- "hit net worth", "finally reached", "hit million"

- "reached FIRE", "retiring early", "quit my job"

- "net worth update", "FIRE journey", "coastfire"

We extracted age, net worth, income (if stated), family status, and profession. We removed duplicates (same author posting multiple times) and excluded posts without extractable financial data.

Final sample: 18 unique individuals with $1M+ milestones, plus additional posts at earlier milestones ($250k - $1M).

Limitations

This is Reddit data with all its biases:

- Self-selection: People post wins, not losses

- Demographics: Reddit skews young, male, US, tech

- Verification: Numbers are self-reported

- Sample size: 18 unique $1M+ posters is small

- Not representative: r/Fire users are not the general population

Take the specific numbers with a grain of salt. The patterns are more interesting than the precise percentages.

Track Your Own Progress

Seeing where others are is interesting. Seeing where you are — and where you're headed — is actionable.

Our Progress Tracker lets you map your entire FIRE journey: assets, liabilities, income streams, and projections. See your milestone timeline. Track your progress over time. No account needed — everything stays in your browser.

Frequently Asked Questions

Based on our analysis of r/Fire milestone posts, the median age to hit $1M+ net worth is 39 years old. Ages ranged from 32 to 50, with a heavy cluster in the mid-30s. This is younger than most people expect.

No. 20% of $1M+ milestone posters never earned over $100,000. The most striking example was a 39-year-old who hit $2.4M while never earning more than $80,000. High income accelerates FIRE, but time in market, savings rate, and consistency matter more.

No. 55% of $1M+ FIRE milestone posters are single. While dual income can accelerate the timeline, more than half of those hitting major milestones did it on a single income. Conversely, couples with multiple children also reach FIRE milestones, proving family status doesn't disqualify you.

Tech and engineering make up about 28% of $1M+ milestone posters and dominate the highest net worth brackets ($5M+). However, the $1-2M range is diverse: healthcare workers, project managers, insurance managers, and other professions are well-represented.

Reddit data has significant biases: self-selection (people post wins, not losses), demographics (skews young, male, US, tech), self-reported numbers, and small sample sizes. The patterns are more meaningful than precise percentages. This is a snapshot, not a scientific study.

Common strategies include starting to invest early (many began at 22-25), living with roommates for extended periods, choosing low-cost hobbies like gaming and hiking, consistent index fund investing, geographic arbitrage in lower cost-of-living areas, and dramatic housing downsizing.