TL;DR

- The mythical "coast job" (chill work, decent pay, good benefits) is extremely rare

- Most people discover this after hitting Coast FIRE—and feel disillusioned

- Being "overqualified" is a real barrier to lower-stress jobs

- 11+ actual paths forward—but none match the fantasy

- Coast FIRE is still worth it; you just need realistic expectations

Haven't calculated your number yet? Use our Coast FIRE calculator first—it takes 30 seconds.

The Fantasy

You grind for years. You max your 401k, invest every bonus, live below your means. Finally, your spreadsheet confirms it: you've hit Coast FIRE.

The math says your $500k will grow to $2M+ by 65. You don't need to save another dime. You just need to cover current expenses.

So you start dreaming. Maybe a remote job paying $80k. Something chill—no more 60-hour weeks, no more Sunday scaries. You'll have time to exercise, cook real meals, actually use your vacation days.

Time to find that coast job.

The Reality Check

Here's what actually happens, according to people who've been there:

"Imagine this. You make about $150k and you hit Coast FI. You don't need to contribute that $50k/year to retirement accounts anymore. Time to go find an easy, chill, (hopefully remote) job that pays $100k! You may have discovered that type of job isn't exactly easy to find." — Top post on r/coastFIRE, 248 upvotes

This resonated because it nailed the collective disappointment. The "coast job"—that mythical role with low stress, decent pay, remote flexibility, and good benefits—is like a unicorn. Everyone's heard of one, but finding it yourself is another story.

The disillusionment hits hard:

"I've seen so many posts on here about people making this discovery. In a way, the 'Coast job' you imagined when you started focusing on Coast FI might not exist... and I think some people react to this like when they found out Santa wasn't real." — r/coastFIRE

Why the Coast Job Doesn't Exist

The Overqualified Problem

One CPA who tried to transition shared their frustration:

"Every interview for my dream coasting job to just do a solid day of work for the health insurance is met with complete skepticism. It's not even thinly veiled in some cases. It's as if no one in their right mind would leave the corporate world to go 'backwards' in their career. So there must be something wrong with me." — CPA attempting to coast, r/coastFIRE

When you have 15 years of experience and impressive credentials, employers don't believe you actually want a $50k job. They assume you'll leave the moment something better comes along—and they're often right.

The Pay-Stress Disconnect

Here's the uncomfortable truth: lower pay doesn't mean lower stress. A $45k customer service job can be more soul-crushing than a $150k engineering role. The difference is the type of stress, not the amount.

Many people who "downshift" find themselves trading intellectual challenges for interpersonal ones, or swapping deadline pressure for boredom and micromanagement.

The Healthcare Cliff

In America, this is the elephant in every Coast FIRE discussion:

"Goddam insurance is expensive! $2300 a month without the employer contribution. That's 40% of what my usual monthly expenses are!" — Recently laid off at 1.5M net worth

The "barista FIRE" concept—working at Starbucks or Costco specifically for health benefits—exists because individual health insurance is prohibitively expensive. But those jobs come with their own trade-offs: rigid schedules, physical demands, and hourly wages.

According to the Bureau of Labor Statistics, healthcare is the fastest-growing expense category for American households, making it the defining factor in many Coast FIRE decisions.

What People Actually Do

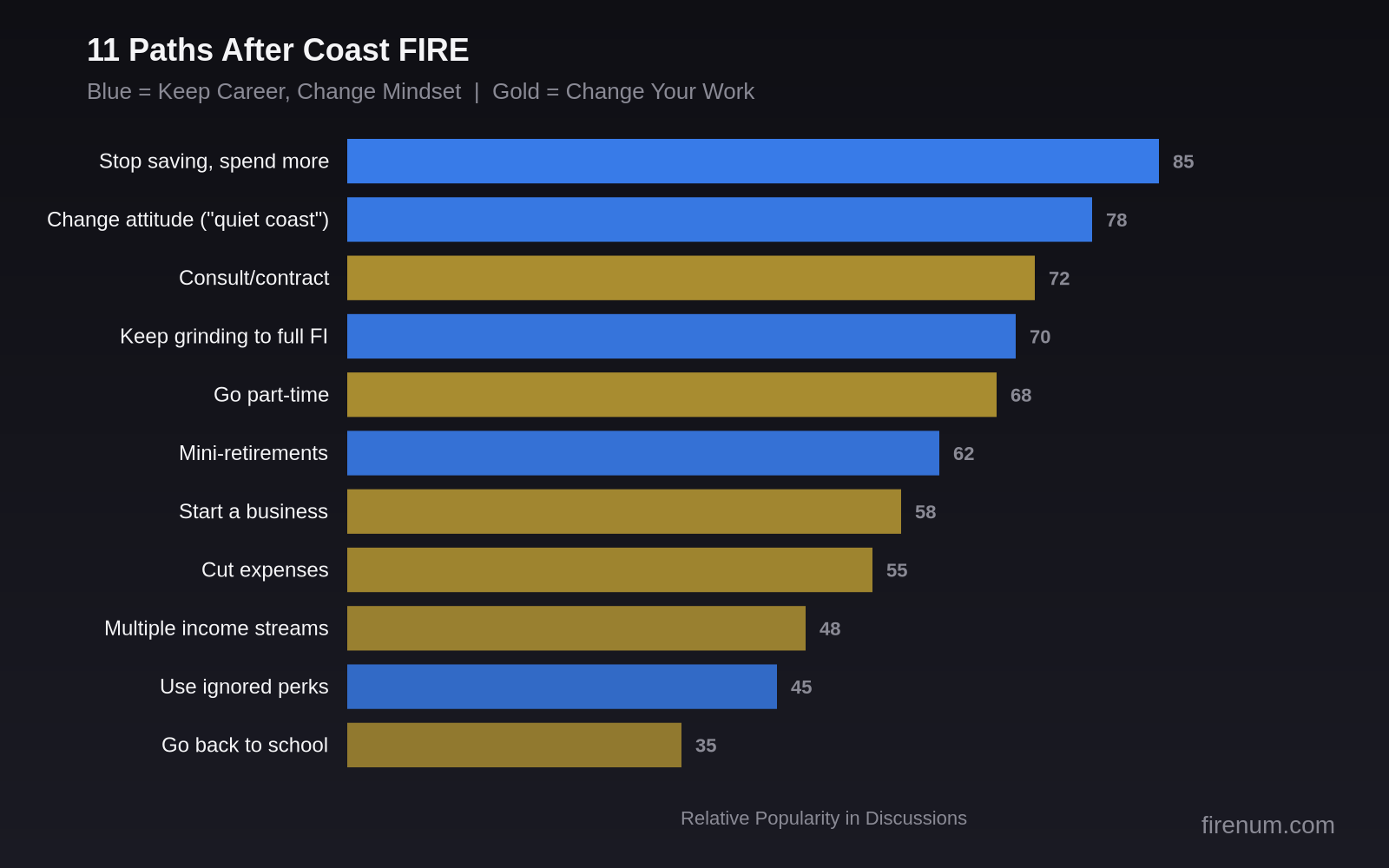

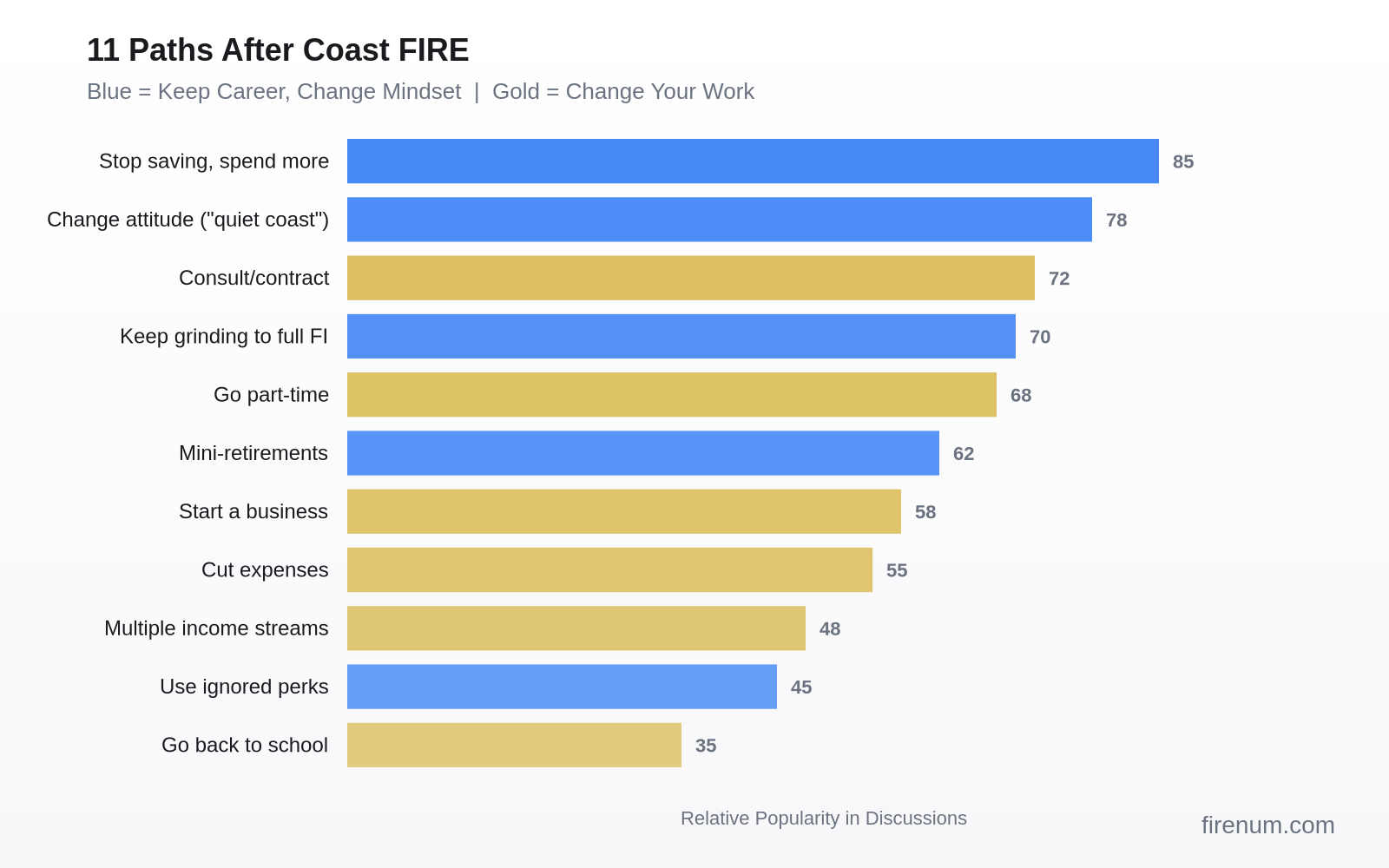

After analyzing hundreds of Coast FIRE discussions on Reddit, here's what the community has actually tried—organized into two categories:

Category A: Keep Your Career, Change Your Mindset

1. Stop saving, start spending. Redirect retirement contributions to travel, hobbies, or one-time purchases. Your lifestyle improves without changing jobs.

2. Take mini-retirements. Build up cash, then take 2-3 months between jobs. Actually use them as a break instead of frantically job hunting.

3. Use perks you've been ignoring. One poster bundled 2 weeks of "work from anywhere" with 2 weeks PTO and spent a month in Europe—without quitting.

4. Change your attitude. "Meets expectations" is a perfectly fine rating when you're not climbing the ladder. Use all your PTO. Say no to extra projects. What are they gonna do, fire you?

5. Just keep going. Coast FIRE at 35 means you're closer to full FI than you think. Another 5-10 years of saving gets you completely out.

Category B: Actually Change Your Work

6. Cut expenses, not income. If you spend less, the $60k job suddenly works. Downsize housing, move to a LCOL area, or question that car payment.

7. Go part-time in your current field. A nurse who hit Coast FIRE dropped to 24 hours/week—keeping full benefits—and called it "the best decision I ever made."

8. Consult or contract. Higher hourly rate, fewer hours. One person makes more per hour than they did as an employee, working 5 hours per week on average.

9. Multiple income streams. Maybe no single coast job exists, but what about two? Teaching plus a side business. Tutoring plus writing. The flexibility to try things is the whole point.

10. Go back to school. A corporate executive quit to get a doctorate in psychology. Coast FIRE gave them the runway to completely reinvent.

11. Start a business. Not a "I need this to work or I'm broke" startup—a "let's see if this works" experiment. The safety net changes everything.

The Emotional Arc

What surprised me most wasn't the strategies—it was the emotional journey.

The Burnout Catalyst

"I was alive but not living. Since putting in my resignation, I removed this huge weight off my shoulders. I'm actually able to put my full focus on conversations, and I'm sleeping a lot better too. I didn't realize how much work was affecting my life outside of work." — 42M who quit with $750k in retirement accounts

The Identity Crisis

Many people spend years defining themselves by their career, then hit Coast FIRE and feel... lost. One poster admitted:

"I couldn't even take a vacation because I felt constantly pressured to respond to emails and carried my laptop with me. I stopped enjoying concerts and couldn't even relax with my friends and family." — r/coastFIRE

The problem wasn't the job. It was an inability to disconnect—something that doesn't magically fix itself when you switch to a "coast job."

The Permission Slip

For others, Coast FIRE isn't about leaving work. It's about finally having permission to live:

"Life does not wait, that's why we CoastFIRE... We can't imagine the things that we would have missed out in the past two years if we had been grinding all along." — Couple who started coasting in their early 30s

They had kids, bought their mother a car she always wanted, started spending for small luxuries. Same jobs, completely different life.

The Real Takeaway

Coast FIRE works. Just not the way you imagined.

The fantasy: "I'll find an easy job and coast into retirement."

The reality: "I have options I didn't have before—and now I need to figure out what I actually want."

That's harder than it sounds. But it's a good problem to have.

A decade into coasting, one couple summed it up:

"Wife and I have been coasting for over a decade and just hit our ChubbyFIRE number. Keep the faith fellow Coasters!" — Mid-50s couple, r/coastFIRE

The path wasn't linear. The coast job probably wasn't what they expected. But they got there.

Frequently Asked Questions

A "coast job" is a hypothetical lower-stress, lower-pay job that someone takes after hitting Coast FIRE. The idea is you no longer need to save for retirement, so you only need to cover current expenses. In practice, finding a job that's genuinely low-stress with decent pay and benefits is much harder than expected.

Yes. Coast FIRE provides financial security and psychological freedom even if you keep your current job. Many Coast FIRE achievers don't change jobs at all — they change their mindset. Knowing you don't need to save gives you permission to spend more, take risks, and set boundaries at work.

Three main reasons: (1) Overqualification — employers don't believe you want a lower-level role and assume you'll leave. (2) Pay-stress disconnect — lower pay doesn't guarantee lower stress. (3) The healthcare cliff — in the US, losing employer health insurance can cost $1,500-$2,300/month, making many lower-paying jobs financially impractical.

The most popular paths: stop saving and spend more at the current job, change attitude to "quiet coasting," go part-time or consult/contract in their field, start a business with the safety net, take mini-retirements between jobs, or cut expenses to make a lower income work. Most people combine multiple strategies.

Your Coast FIRE number depends on your age, expected return rate, and FIRE number. For example, a 35-year-old targeting $1.5M by age 60 at 7% returns needs roughly $300,000 invested today. The younger you are, the less you need because compound growth has more time to work. Use our Coast FIRE calculator for your exact number.

No. Coast FIRE means you keep working (often full-time) but stop saving — your investments grow to your FIRE number on their own. Barista FIRE means you leave full-time work and take part-time work to cover expenses while your investments grow. Coast FIRE changes what you do with your money; Barista FIRE changes what you do with your time.

Calculate Your Coast FIRE Number

Before you can rethink the strategy, you need to know the number. How much do you need invested today so that compound growth carries you to traditional retirement?