The Honest Truth

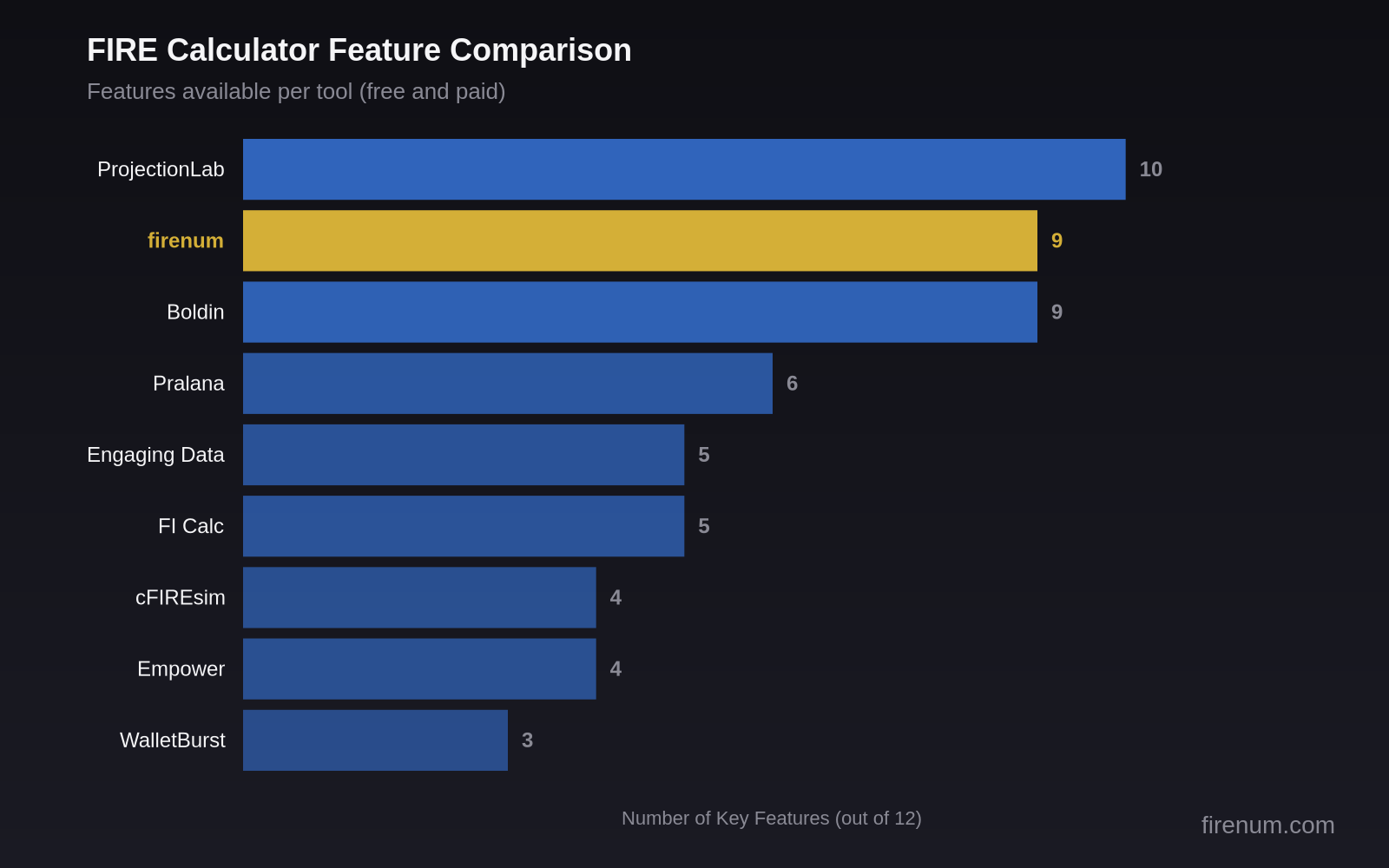

There are dozens of FIRE calculators. Some cost $100+/year. Some have features we don't. Here's an honest comparison so you can pick the right tool for your needs.

We built firenum.com because we wanted something specific: a fast, private, multi-currency calculator suite that works offline. That's our niche. Other tools excel at different things.

Research from Vanguard confirms what we've seen firsthand: "Investors who use financial planning tools report 25% higher confidence in their retirement readiness." The right calculator isn't just about features — it's about building confidence in your plan.

If Monte Carlo simulations or tax optimization matter more to you than privacy and multi-currency support, there are better options. We'll tell you which ones.

Quick Comparison

| Feature | firenum | Engaging Data | FI Calc | ProjectionLab | Boldin |

|---|---|---|---|---|---|

| Price | Free | Free | Free | $109/yr | $144/yr |

| Account Required | ✗ | ✗ | ✗ | ✓ | ✓ |

| Multi-Currency | ✓ 8 currencies | ✗ | ✗ | ✗ | ✗ |

| Progress Tracking | ✓ | ✗ | ✗ | ✓ | ✓ |

| Stress Test Scenarios | ✓ 6 scenarios | ✗ | ✓ via backtesting | ✓ | ✓ |

| One-Time Events | ✓ | ✗ | ✗ | ✓ | ✓ |

| Monte Carlo | ✗ | ✓ | ✗ | ✓ | ✓ |

| Historical Backtesting | ✗ | ✗ | ✓ 100+ years | ✓ | ✗ |

| Tax Optimization | ✗ | ✗ | ✗ | ✓ | ✓ |

| Mobile-First | ✓ | ~ | ✓ | ✓ | ~ |

| Works Offline | ✓ | ✗ | ✗ | ✗ | ✗ |

| 100% Private | ✓ localStorage only | ✓ | ✓ | ✗ | ✗ |

What firenum Does Best

Stress Test Scenarios

6 built-in scenarios: market crash (timing, severity, recovery), lower returns, income loss, expense spike, high inflation (with duration), and retire earlier/later. See how your plan holds up when things go wrong.

Multi-Currency Support

8 currencies: USD, EUR, GBP, CAD, AUD, CHF, JPY, INR. Most FIRE calculators are US-only. If you live outside the US or hold assets in multiple currencies, this matters.

One-Time Events

Model windfalls, inheritance, home sales, or large purchases at specific future dates. See exactly how a $50k bonus in 3 years or a $200k home sale at retirement changes your trajectory.

100% Private

Your data never leaves your device. No account required, no cloud sync, no analytics on your financial data. Everything stays in localStorage. Works offline too.

Plus: 8 calculators in one place, mobile-first design, dark/light themes, no ads, sub-second load times.

Where Competitors Excel

Let's be honest about our limitations. These tools do things we don't:

Monte Carlo Simulations

Monte Carlo simulations are more comprehensive than our fixed-rate projections. If stress-testing against thousands of random scenarios matters to you, Engaging Data or ProjectionLab are better choices.

Historical Backtesting

FI Calc and cFIREsim can show how your portfolio would have performed starting from any year in the last 100+. This is valuable for understanding sequence-of-returns risk.

Tax Optimization

Boldin and Pralana model Roth conversions, tax-loss harvesting, and Social Security timing. If you're optimizing for US taxes, these tools are significantly more sophisticated.

Account Aggregation

Empower (formerly Personal Capital) pulls balances from all your accounts automatically. Convenient if you have accounts spread across many institutions.

Detailed Competitor Reviews

Free Tools

Engaging Data

FreeBest for: Monte Carlo simulations

Strengths

- Detailed Monte Carlo analysis

- Multiple withdrawal strategies

- Social Security integration

Limitations

- US-focused

- Single currency

- No progress tracking

FI Calc

FreeBest for: Historical backtesting

Strengths

- 100+ years of historical data

- Multiple portfolio strategies

- Variable spending models

Limitations

- US market data only

- Single currency

- No ongoing tracking

cFIREsim

FreeBest for: Community-validated simulations

Strengths

- Long-standing community tool

- Flexible spending rules

- Historical analysis

Limitations

- Dated interface

- US-only

- No mobile optimization

WalletBurst

FreeBest for: Clean visualizations

Strengths

- Beautiful charts

- FIRE timeline calculator

- Savings rate focus

Limitations

- Fewer calculator types

- US-focused

- Limited customization

Paid Tools

ProjectionLab

$109/yearBest for: Best overall paid option

Strengths

- Comprehensive scenario planning

- Monte Carlo + historical

- Tax-aware projections

- Beautiful interface

Limitations

- Subscription cost

- Learning curve

- Account required

Boldin (NewRetirement)

$144/year (Plus)Best for: Tax optimization

Strengths

- Detailed tax modeling

- Social Security optimization

- Roth conversion planning

Limitations

- Higher cost

- US tax-focused

- Complex for simple needs

Pralana

$119 one-timeBest for: Complex scenarios

Strengths

- Excel-based flexibility

- Detailed tax modeling

- One-time payment

Limitations

- Spreadsheet required

- Steep learning curve

- Windows-focused

Empower (Personal Capital)

Free tools (0.89% AUM for advisory)Best for: Account aggregation

Strengths

- Free account aggregation

- Fee analyzer

- Investment checkup

Limitations

- Pushes advisory services

- Privacy concerns

- Free tier limited

Spreadsheets

Sometimes a spreadsheet is the right tool. These are the best free FIRE spreadsheets:

Mad Fientist FI Spreadsheet

The gold standard free FIRE spreadsheet. Comprehensive tracking with clear instructions.

Download →Big ERN SWR Toolbox

Deep safe withdrawal rate analysis. Best for understanding sequence-of-returns risk.

Download →How to Choose

- Privacy is paramount? → firenum (100% local storage)

- Live outside the US? → firenum (multi-currency)

- Need Monte Carlo simulations? → Engaging Data (free) or ProjectionLab (paid)

- Want historical backtesting? → FI Calc or cFIREsim

- Need tax optimization? → Boldin or Pralana

- Want automatic account aggregation? → Empower

- Best overall paid option? → ProjectionLab ($109/yr)

- Prefer spreadsheets? → Mad Fientist FI Spreadsheet

- Want fast, simple, and free? → firenum

Frequently Asked Questions

Monte Carlo simulations add complexity without dramatically changing outcomes for most users. Our fixed-rate projections using 5% real returns are based on conservative historical averages. For most planning purposes, this is sufficient. If you want Monte Carlo, Engaging Data or ProjectionLab are excellent choices.

Yes, completely free. No accounts, no premium tier, no ads. The site runs on minimal infrastructure costs. We may add affiliate links to recommended books or services in the future, but the calculators will always be free and ad-free.

All FIRE calculators are projections based on assumptions about future returns. None can predict the future. The value is in understanding the math and relationships between variables (savings rate, expenses, returns) rather than getting an exact retirement date. Use any calculator as a planning tool, not a guarantee.

Yes, especially for major decisions. Different calculators use different assumptions and may highlight different aspects of your plan. If multiple calculators give similar answers, that's a good sign. If they differ wildly, investigate why.

Paid calculators typically offer advanced features like account aggregation, tax optimization, Social Security integration, and Monte Carlo simulations. They also provide ongoing development and support. Whether the cost is worth it depends on your complexity and how much you'll use the advanced features.

Absolutely. Account aggregation is a convenience feature, not an accuracy feature. You can manually input your balances into any calculator. The math is the same whether your data is pulled automatically or entered by hand. Manual entry also means your financial data never leaves your device.

Ready to run the numbers?