TL;DR

- Morningstar's 2026 number: 3.9% safe starting rate (up from 3.7%)

- Flexible spending pushes the safe rate to ~5-6%

- Real retirees only withdraw 2.1% — the underspending problem is real

- For FIRE: 4% works for 30 years; use 3.0-3.5% for 50-year horizons

- Bottom line: The 4% rule isn't dead. It's a starting point, not a suicide pact.

Want the deep dive? Read our full 4% Rule Guide for the history, math, and practical application.

What Morningstar Actually Said

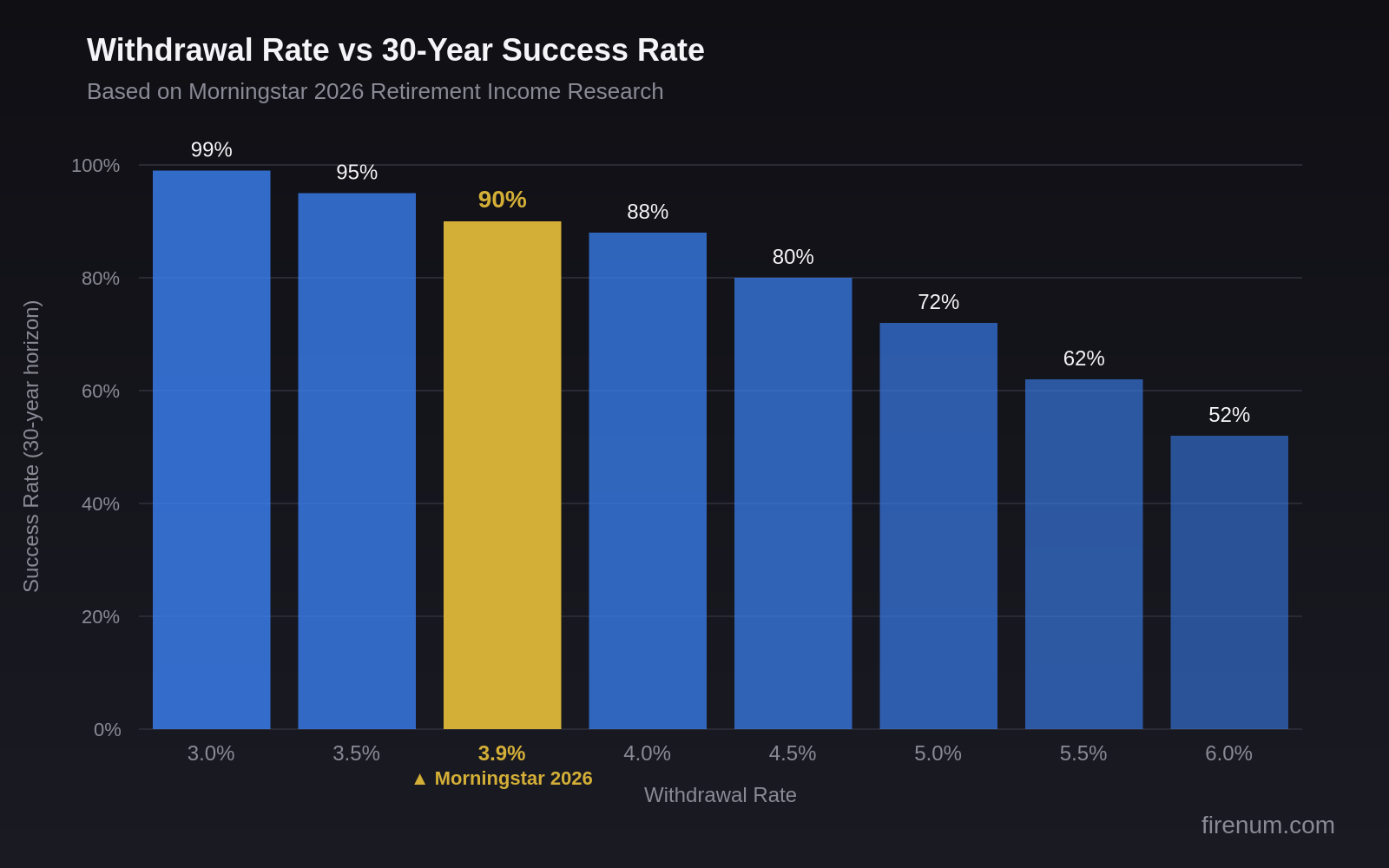

Every year, Morningstar publishes updated retirement income research. Their 2026 report sets the safe starting withdrawal rate at 3.9% for a 30-year retirement with a 90% success probability.

That's up from 3.7% in their previous analysis. The reason: modestly higher expected returns from current market valuations and bond yields. Nothing dramatic — just the math doing its thing.

Here's what that looks like in practice:

| Withdrawal Rate | 30-Year Success Rate | What It Means |

|---|---|---|

| 3.5% | ~95%+ | Very conservative — almost never fails |

| 3.9% | 90% | Morningstar's 2026 recommendation |

| 4.0% | ~88% | The classic Bengen rule — still solid |

| 4.5% | ~80% | Getting risky for fixed withdrawals |

| 5.0% | ~72% | Only viable with flexible spending |

The headline "3.9% not 4%" makes for good financial media drama. In reality, the difference between 3.9% and 4.0% on a $1,500,000 portfolio is $125/month. That's a grocery trip.

Bengen himself has pushed back on the doom-and-gloom framing. As he told the Journal of Financial Planning: "The 4 percent rule is actually the safe withdrawal rate for a worst-case scenario in history. If you're willing to be flexible, it's probably too conservative."

The real story isn't the 0.1% difference. It's what happens when you stop treating this number as gospel and start building flexibility into your plan.

The Flexible Spending Game-Changer

The 4% rule assumes the worst possible behavior: you withdraw the exact same inflation-adjusted amount every year, regardless of what markets do. Portfolio drops 40%? Keep withdrawing. Portfolio doubles? Withdraw the same.

Nobody actually does this.

Morningstar's research shows that flexible spending strategies can safely support 5-6% starting withdrawal rates. Here are the three main approaches:

1. Constant Percentage Method

Withdraw a fixed percentage of your current portfolio each year. If your portfolio drops, you spend less. If it grows, you spend more.

The catch: your income is volatile. A 30% market crash means a 30% pay cut. That's fine if you have spending flexibility. It's not fine if every dollar is committed to fixed expenses.

2. Endowment Method (10-Year Rolling Average)

Withdraw a percentage of your portfolio's 10-year rolling average value. This smooths out the volatility — you don't get the full benefit of bull markets immediately, but crashes don't slash your income overnight.

University endowments use this approach for a reason: it works. Morningstar's data suggests this method supports a starting withdrawal rate of approximately 5.4%.

3. Guardrails Strategy

Set upper and lower spending limits. When your portfolio grows enough that your withdrawal rate drops below the floor (say 3.5%), you give yourself a raise. When it drops enough that your rate exceeds the ceiling (say 5.5%), you cut back.

This is probably the most practical approach for early retirees. You get predictable income most of the time, with adjustments only when things get extreme.

All three approaches share one insight: the willingness to spend less when markets are bad is worth more than any asset allocation decision you'll ever make.

Christine Benz, Morningstar's director of personal finance and retirement planning, put it simply: "The starting withdrawal rate matters far less than your willingness to adjust spending along the way. Flexibility is the single most powerful lever retirees have."

The Plot Twist: Retirees Are Spending Too Little

Here's the finding that flips the entire "is 4% safe?" debate on its head.

Research on actual retiree behavior consistently shows that married retirees withdraw only about 2.1% of their portfolio annually. Singles withdraw even less — around 1.9%.

Read that again. While the internet argues about whether 3.9% or 4.0% is the "right" number, real retirees are withdrawing at half those rates.

The underspending problem is real. People who spent decades accumulating wealth often can't flip the switch to spending it. They die with portfolios larger than what they retired with. Their heirs get the money. Their younger selves got the anxiety.

Research from the Employee Benefit Research Institute confirms it: "Retirees with $500,000 or more at retirement still had, on average, 88% of their pre-retirement assets remaining after 18 years." The money piles up unspent.

There's a clinical name for this: money anxiety. And it doesn't care how much you have saved. The fear of running out doesn't correlate with the probability of running out.

If you're going to worry about a withdrawal rate problem, it might be the opposite one you expected: not spending too much, but spending too little. The risk isn't poverty in old age — it's an impoverished life along the way.

What This Means for FIRE

The original 4% rule was designed by William Bengen in 1994 and validated by the Trinity Study in 1998. Both assumed a 30-year retirement starting at age 65.

If you're retiring at 35, you need your money to last 50-60 years, not 30. That changes the math.

Longer horizons need lower rates

For a 50-year retirement, most researchers recommend a starting withdrawal rate of 3.0-3.5%. That translates to a FIRE multiplier of roughly 28-33x your annual expenses instead of the standard 25x.

| Retirement Length | Safe Withdrawal Rate | Multiplier | FIRE Number ($60k/yr) |

|---|---|---|---|

| 30 years (traditional) | 3.9-4.0% | 25x | $1,500,000 |

| 40 years (retire at 50) | 3.4-3.6% | 28x | $1,680,000 |

| 50 years (retire at 40) | 3.0-3.3% | 30-33x | $1,800,000-$2,000,000 |

| 60 years (retire at 35) | 2.8-3.0% | 33-36x | $2,000,000-$2,160,000 |

But FIRE has built-in advantages

Early retirees aren't actually comparable to traditional retirees in several important ways:

- Earning potential: A 35-year-old "retiree" can go back to work. A 75-year-old usually can't. This is a massive safety valve that doesn't show up in withdrawal rate research.

- Flexible spending: Someone who saved 50-70% of their income to reach FIRE early has already demonstrated they can cut spending. They're the exact population most likely to succeed with flexible withdrawal strategies.

- Social Security: If you're in the US, Social Security kicks in at 62-67, reducing your withdrawal needs for the second half of your retirement.

- Part-time income: Even $15,000/year from part-time work or side projects reduces your portfolio withdrawal by $15,000/year. That's massive over decades.

Want to model this yourself? Our Retirement Projector lets you adjust return rates, time horizons, and contributions to see exactly how the math plays out.

Our Take

After digging through the research, here's our honest assessment:

Use 4% (25x) as your planning target. It's close enough to Morningstar's 3.9% that the difference doesn't matter, and it's a clean number that's easy to calculate with. If you're spending $50,000/year, target $1,250,000.

Build in flexibility, not a bigger number. The difference between a 3.5% and 4% withdrawal rate on $60,000/year spending is $214,000 more you need to save. That could be 2-3 extra years of work. Instead, develop the skill of adjusting spending. Cut discretionary expenses 15-20% when markets crash. That flexibility is worth more than a bigger portfolio.

Track your actual spending. Most people don't know what they really spend. They know their income, their rent, their car payment — but not the full picture. Without knowing your real number, any withdrawal rate is a guess. Our Progress Tracker helps you monitor this over time.

Don't let the perfect rate paralyze you. The real risk for most people pursuing FIRE isn't withdrawing 4.0% instead of 3.9%. It's spending an extra decade working a job they hate because they couldn't decide between 25x and 28x. Run the numbers, build a plan, and adjust as you go.

For the full history and math behind the 4% rule, see our comprehensive guide. For the research sources we rely on, check our References page.

Frequently Asked Questions

Morningstar's 2026 research sets the safe starting withdrawal rate at 3.9% for a 30-year retirement with 90% success probability. This is up from 3.7% in their previous analysis, driven by modestly higher expected returns. For practical purposes, 4% remains a reasonable planning number for traditional 30-year retirements.

For early retirees with 40-50+ year horizons, most researchers recommend a lower starting rate of 3.0-3.5%. The original 4% rule was designed for 30-year retirements. However, flexible spending strategies and the ability to earn supplemental income can make higher rates work in practice.

Fixed withdrawal means taking the same inflation-adjusted dollar amount each year regardless of market performance. Flexible withdrawal adjusts spending based on portfolio performance — spending more in good years and less in bad years. Flexible strategies can safely support withdrawal rates of 5-6%, but require comfort with variable income.

If you're retiring before 50 and need your portfolio to last 40+ years, starting at 3.5% adds a meaningful safety margin. This means a 25x multiplier becomes roughly 28-29x. For someone spending $60,000/year, that's $1.71M instead of $1.5M. Whether the extra buffer is worth the additional saving time depends on your risk tolerance and ability to adjust spending.

Sequence of returns risk is the danger that poor market returns early in retirement permanently damage your portfolio. A 30% market drop in year 1 of retirement is far more damaging than the same drop in year 15, because you're withdrawing from a depleted portfolio. This is the primary reason the safe withdrawal rate is lower than average market returns.

The 4% rule already accounts for inflation — the original research assumed withdrawals increase each year to maintain purchasing power. In high-inflation environments, your nominal withdrawals grow faster, putting more stress on the portfolio. Morningstar's 3.9% figure incorporates current inflation expectations. If inflation runs hotter than expected, flexible spending becomes even more important.

Ready to run the numbers?