TL;DR

- Coast FIRE: Stop saving, keep working full-time, let investments grow to your FIRE number by 60-65

- Barista FIRE: Quit full-time, work part-time to cover expenses while investments grow

- Key difference: Coast changes what you do with your money. Barista changes what you do with your time

- Healthcare is the deciding factor for most Americans choosing between the two

- They're not mutually exclusive. Many people Coast first, then Barista later

Need your numbers first? Use our Coast FIRE Calculator or Barista FIRE Calculator -- both take 30 seconds.

The Core Difference in One Sentence Each

Coast FIRE changes what you do with your money. You stop saving for retirement. Your existing investments compound to your FIRE number on their own. You keep working and spend your entire paycheck.

Barista FIRE changes what you do with your time. You leave full-time work. You work part-time to cover daily expenses while your investments grow or you partially draw them down.

Same destination. Completely different experience of the journey.

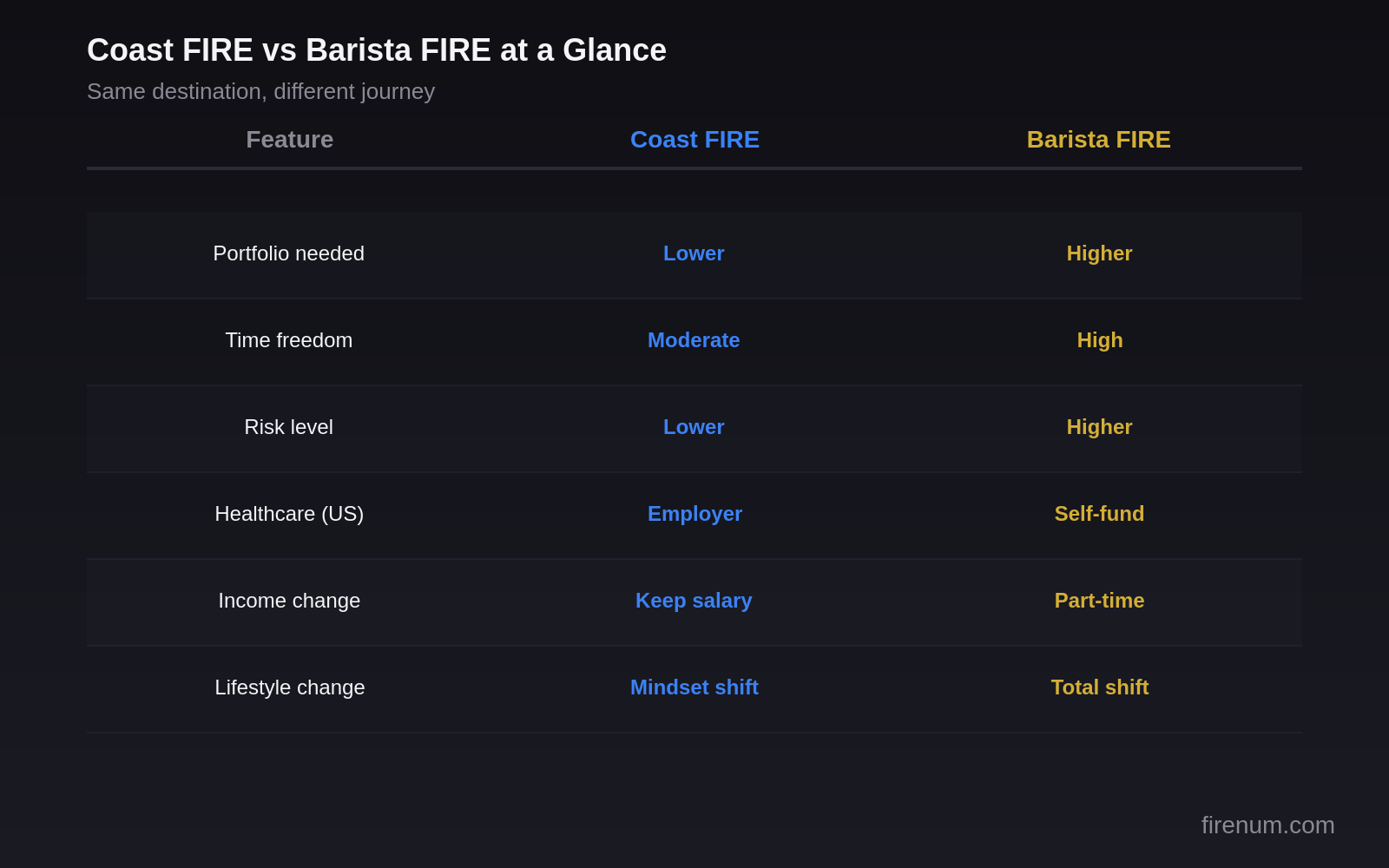

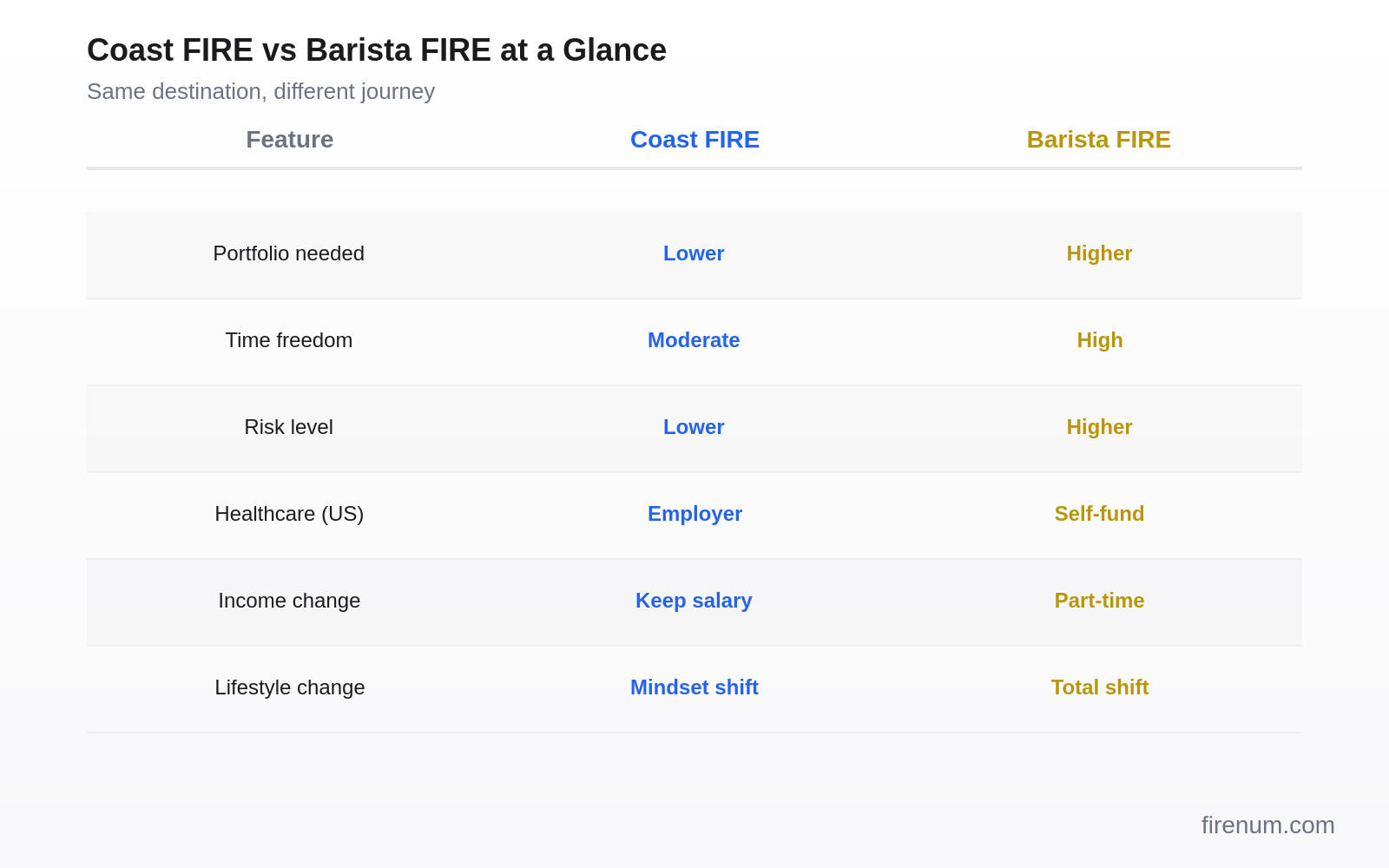

Side-by-Side Comparison

| Feature | Coast FIRE | Barista FIRE |

|---|---|---|

| Definition | Stop saving, let growth do the work | Leave full-time, work part-time |

| When you stop saving | Now | Now |

| When you stop working | Traditional retirement (60-65) | Immediately (part-time only) |

| Income needed | Full living expenses | Expenses minus portfolio withdrawal |

| Risk level | Lower | Higher |

| Healthcare (US) | Employer benefits | Must solve independently |

| Time freedom | Moderate (less pressure at work) | High (part-time = flexible) |

| Portfolio needed | Lower (time does the work) | Higher (need partial withdrawals) |

| Mental model | Marathon with a lighter pack | Sprint to the campsite |

How the Math Works: A Worked Example

Let's use a concrete person to compare both paths:

- Age: 35

- Current portfolio: $500,000

- Annual expenses: $60,000

- Expected return: 7% nominal

- FIRE number: $1,500,000 ($60K x 25)

Coast FIRE Path

$500,000 at 7% returns grows to roughly $2,000,000 in 21 years (by age 56) -- without a single additional contribution. If you're willing to wait until 60, it reaches ~$2,700,000.

What changes: You stop contributing to your 401k, IRA, and brokerage. That's potentially $30,000-$50,000/year freed up. You keep your full-time job but spend your entire paycheck. Travel more. Upgrade your lifestyle. Say yes to things you've been deferring.

What stays the same: You still go to work Monday through Friday. You still have a boss. You still deal with meetings and deadlines. But the pressure is different -- you're not climbing a ladder, you're coasting down a hill.

Barista FIRE Path

You need your part-time income plus portfolio withdrawals to cover $60,000/year in expenses.

At a 4% withdrawal rate, $500,000 provides $20,000/year. That leaves a $40,000 gap that part-time work needs to cover.

Can you earn $40,000/year part-time? That's roughly $20/hour at 40 weeks per year, 50 hours per week -- which isn't really "part-time" anymore. More realistically, at 25 hours per week, you'd need about $32/hour.

The honest math: At $500,000, Barista FIRE works if you either (a) reduce expenses, (b) earn more per hour part-time, or (c) accept a higher withdrawal rate. Many people find they need closer to $750,000 for comfortable Barista FIRE at $60,000 in annual expenses.

At $750,000: 4% withdrawal = $30,000/year from investments. Gap = $30,000 from part-time work. That's $25/hour, 24 hours/week, 50 weeks/year. Much more realistic.

Who Should Choose Coast FIRE

Coast FIRE is the right path if:

- You like your job but hate the pressure. Coast FIRE lets you mentally check out of the rat race while keeping the paycheck and benefits. "Meets expectations" becomes a perfectly fine performance review

- You want employer benefits. Health insurance, 401k match (even if you're not contributing extra), dental, vision, life insurance -- all of this comes free with employment

- You're risk-averse. Coast FIRE has the lowest risk profile of any FIRE variant. You're still fully employed. The only thing that changes is where your savings go

- You're in your 30s with time. The younger you are, the more powerful compound growth becomes. Coast FIRE at 32 with $300,000 is remarkably effective

- You value stability over freedom. Some people genuinely prefer structure. Coast FIRE gives you financial peace without lifestyle upheaval

For more on what the "coast job" actually looks like, read The Coast FIRE Myth: What Nobody Tells You. Spoiler: the mythical low-stress coast job is harder to find than you'd think.

Who Should Choose Barista FIRE

Barista FIRE is the right path if:

- You're burned out NOW, not eventually. If you can't stand another year of full-time work, Barista FIRE is the escape hatch. Coast FIRE doesn't help if the problem is showing up 40+ hours per week

- You have healthcare covered. Spouse's employer plan, a country with universal healthcare, or you've priced out ACA marketplace plans and they fit your budget

- You're comfortable with uncertainty. Barista FIRE has more variables: part-time job availability, fluctuating hours, market returns affecting your withdrawal. You need to be okay with that

- You have diverse, transferable skills. Consulting, tutoring, freelancing, skilled trades -- the more ways you can earn $20-$40/hour on your own terms, the better Barista FIRE works

- You prioritize time over security. Barista FIRE gives you your hours back. You might work 20 hours/week instead of 50. That's 30 hours per week of your life returned to you

Use our Barista FIRE Calculator to see exactly how part-time income changes your FIRE number.

The Hybrid Approach

Here's what most people don't realize: Coast FIRE and Barista FIRE aren't either/or choices. They're points on a spectrum, and many people move between them.

The common path:

- Hit Coast FIRE. Stop saving aggressively. Redirect contributions to living better

- Coast for 3-5 years. Portfolio grows while you enjoy a less pressured version of your career

- Transition to Barista FIRE. Your portfolio is now larger (thanks to 3-5 years of growth), making the part-time income gap smaller

- Eventually reach full FIRE. Or just keep coasting. Both are fine

"Hit Coast FIRE at 34, spent 4 years actually enjoying my corporate job since the pressure was gone. Left at 38 for part-time consulting. My portfolio had grown from $450K to $650K in those 4 years without a single contribution. That extra $200K made Barista FIRE way more comfortable." -- 38M, former corporate, now part-time consultant

The hybrid approach reduces risk at every stage. You're never making a dramatic, irreversible leap. You're gradually shifting from full-time to part-time to optional.

The Healthcare Elephant in the Room

For Americans, healthcare is often the real deciding factor. Let's be blunt about the numbers.

With Coast FIRE (employer coverage): You might pay $200-$600/month for your share of premiums. Your employer covers the rest -- typically $1,000-$2,000/month in hidden benefit value.

With Barista FIRE (no employer coverage):

- ACA marketplace: $400-$1,500/month depending on income (which you can control in Barista FIRE to qualify for subsidies)

- COBRA: Full price of your old employer plan, typically $1,500-$2,300/month. 18-month bridge only

- Part-time with benefits: Starbucks (20+ hrs/week), Costco, UPS, and some healthcare employers offer benefits to part-timers. But these jobs come with schedule constraints

"Healthcare costs were what kept me at my full-time job for 3 extra years. Once I did the ACA math and realized I could keep my modified AGI under $50K through careful Roth conversions, Barista FIRE became viable." -- 41F who transitioned from Coast to Barista FIRE

If you're outside the US with universal healthcare, this entire section is irrelevant and Barista FIRE becomes dramatically more accessible. It's one of the reasons FIRE communities in Canada, the UK, and Europe skew more toward Barista FIRE.

For more perspectives on Coast FIRE from those who've tried it, see the discussions on r/coastFIRE and r/baristaFIRE.

For the full breakdown of FIRE types including Coast and Barista, see our FIRE Types Comparison page.

Making Your Decision

Ask yourself these three questions:

- Is your problem the money or the time? If you hate saving but like your job, Coast FIRE. If you hate your schedule, Barista FIRE.

- How do you handle uncertainty? Coast FIRE is the safe bet. Barista FIRE requires comfort with variability. Know yourself honestly.

- What's your healthcare situation? If you're in the US without a spouse's plan, Coast FIRE keeps the safety net. If healthcare is solved, the decision is purely about lifestyle.

Neither path is wrong. Both get you to the same place: a life where work is optional. The question is just how much freedom you want now versus how much certainty you need.

For the foundational math behind both approaches, our 4% Rule guide covers the withdrawal rate research.

Frequently Asked Questions

Yes, and many people do. A common approach is to hit Coast FIRE first (stop saving, keep working full-time), then transition to Barista FIRE later (switch to part-time work). Coast FIRE is often the stepping stone that makes Barista FIRE possible. You coast for a few years to build additional buffer, then drop to part-time with more confidence.

Coast FIRE is typically achieved first because it requires a lower portfolio balance. You only need enough invested so that compound growth reaches your FIRE number by traditional retirement age (60-65). Barista FIRE requires enough that partial withdrawals plus part-time income cover your expenses now, which usually means a larger portfolio.

This is the critical difference for Americans. Coast FIRE keeps you in full-time employment, so you typically keep employer-sponsored health insurance. Barista FIRE requires solving healthcare independently: ACA marketplace plans, a spouse's employer plan, or part-time jobs that offer benefits (Starbucks, Costco, UPS). Healthcare costs can be $500-$2,300/month without employer coverage.

Yes, and this is one of the underappreciated safety nets. Your skills don't evaporate. Many people who try Barista FIRE and find it doesn't suit them return to full-time work within 1-2 years. The gap on your resume is easily explained, and your financial position is likely stronger than when you left. The risk of trying is lower than most people think.

Your Coast FIRE number is how much you need invested today so that compound growth alone reaches your full FIRE number by age 60-65. For example, $500K today at 7% returns reaches $2M in about 20 years. Your Barista FIRE number is how much you need so that a safe withdrawal (typically 3.5-4%) plus part-time income covers your annual expenses. These are different calculations with different inputs.

For Coast FIRE: determine your FIRE number (annual expenses x 25), then calculate how much you need invested today so that compound growth at your expected return rate reaches that number by your target retirement age. For Barista FIRE: subtract your expected part-time income from your annual expenses, then multiply the remaining gap by 25. Use our Coast FIRE and Barista FIRE calculators for exact numbers.

Ready to run the numbers?